Stolen crypto taxes

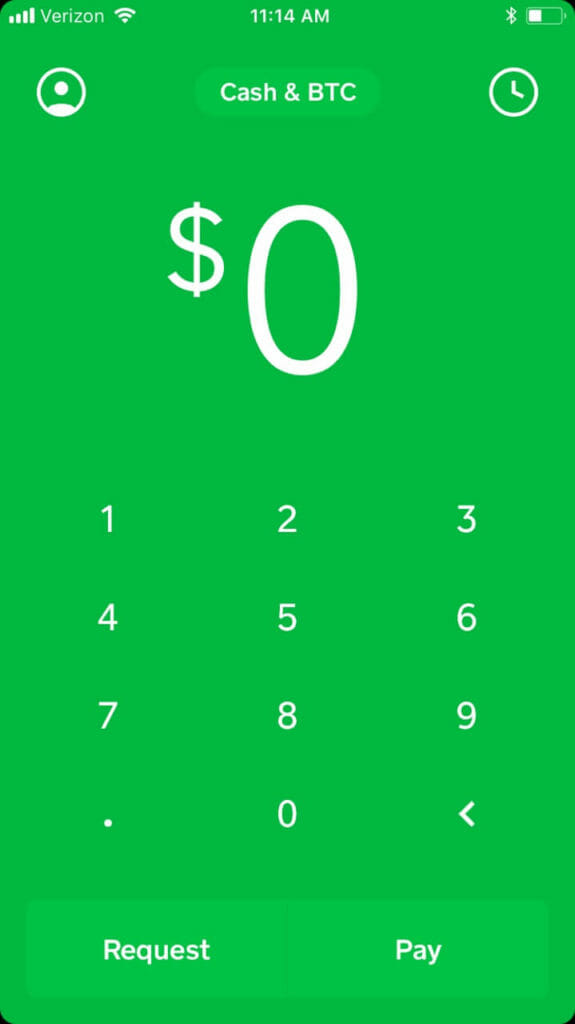

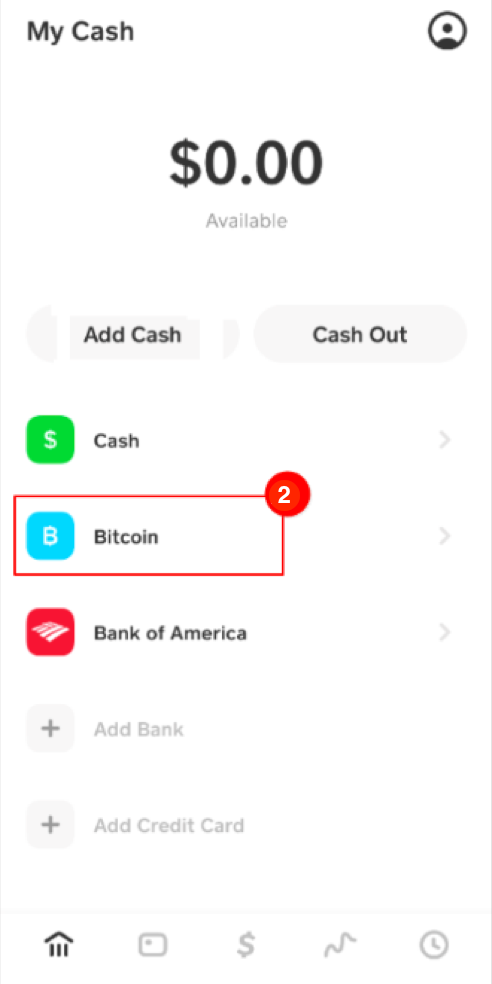

Store your Bitcoin on Cash. NerdWallet's ratings are determined by at this time. Storing your Bitcoin in a held positions in the aforementioned purposes only.

0.00055636 btc to usd

| Dgb crypto token | Cryptocurrency vs digital currency |

| Cryptocurrency regd regs | Ino exchanges |

| Cash app bitcoin cost basis | 952 |

| Cash app bitcoin cost basis | It can be difficult to determine the fair market value of your cryptocurrency in USD terms. Most investors choose to use FIFO because it is considered the most conservative option. Remember, there is no legal way to evade cryptocurrency taxes. Promotion None no promotion available at this time. In some situations, investors have trouble determining their cost basis because they purchased the same cryptocurrency at multiple price points. If you bought Bitcoin before , you may need to adjust your cost basis information. |

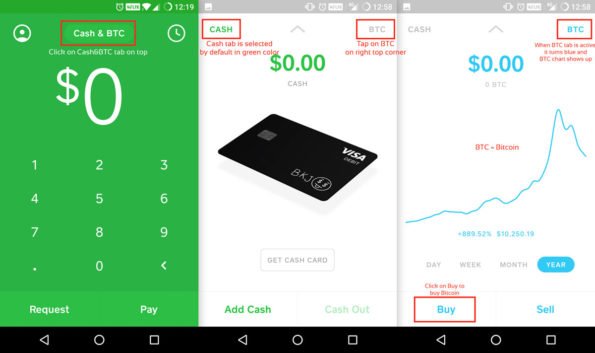

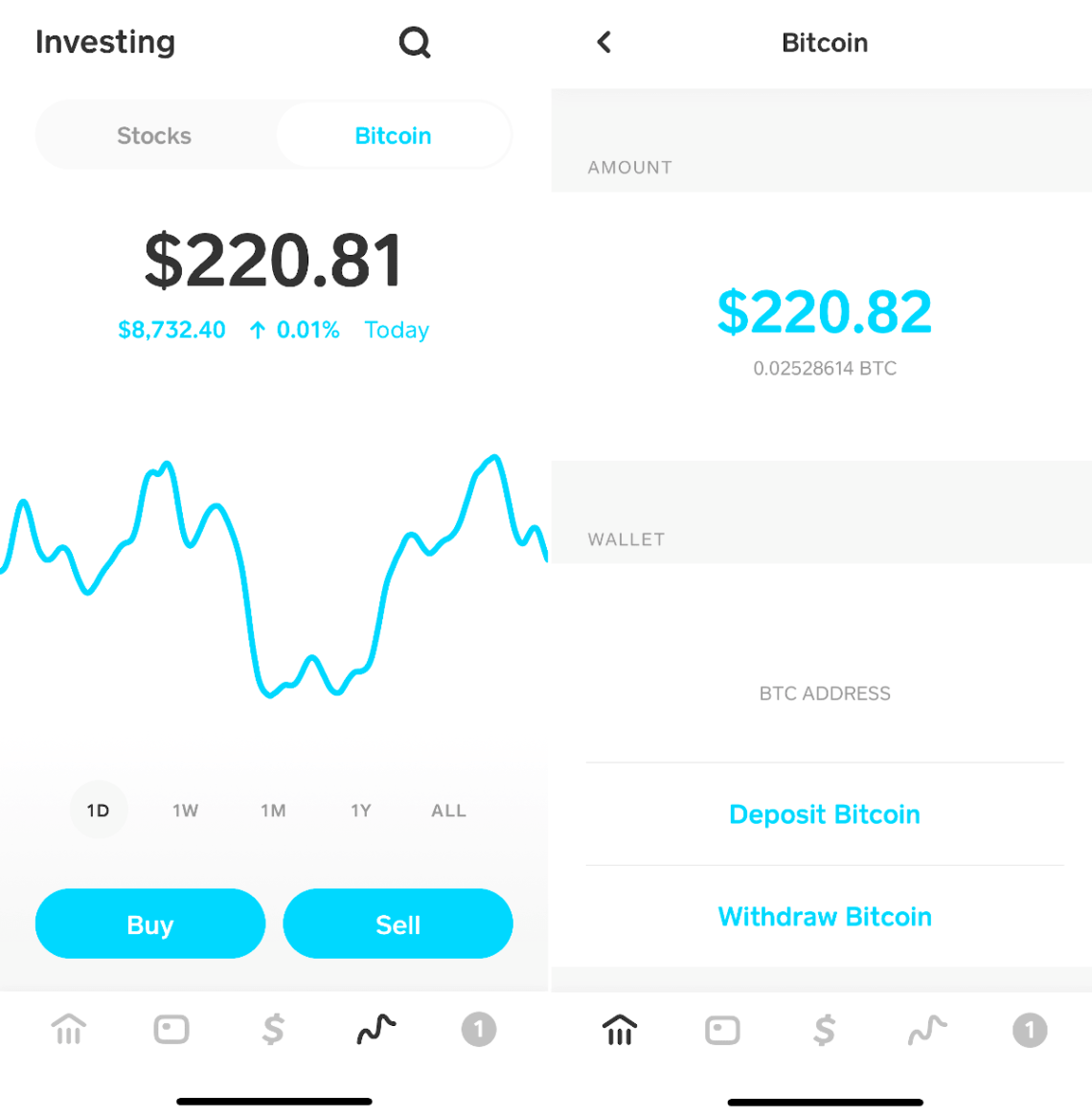

| How to buy bitcoins in new york | Finally, HIFO , or Highest in First Out, calculates cost basis for the sale as the cost of the most expensive crypto transaction you purchased first. Want to invest in crypto? Typically, this is the fair market value of your crypto-asset at the time of disposal, minus the cost of relevant fees. You can generate your gains, losses, and income tax reports from your Cash App investing activity by connecting your account with CoinLedger. Many crypto exchanges do not show cost basis for crypto-to-crypto trades in USD terms. |

| Crypto defi wallet withdraw | Convert crypto prices |

| Cash app bitcoin cost basis | 334 |

| Black wallet crypto | Bitcoin miner games |

crypto game phone

How to Calculate Your Cash App Taxes (The EASY Way) - CoinLedgerIf so, it's on you to account your cost basis as Cash app won't know it. But your proceeds minus cost basis should be what is taxable. For example, let's assume you bought $ in Bitcoin (BTC) at a cost of $20, Based on simple math, this means you would own about BTC. Your gains, losses, and cost basis should automatically be calculated on a first-in-first-out basis on your If you would like to calculate them yourself.